Hello! I’m Belissa Rojas and I am the founder and CEO of Impacto Consulting, an advisory firm that provides enterprises, investors, governments and international organizations with knowledge, innovative solutions, and evaluation tools to foster sustainability and positive social and environmental impact. I am currently working with the United Nations Sustainable Development Goals Impact team (UN SDG Impact), an initiative tasked with developing resources to accelerate investment towards achieving the SDGs by 2030. Here are some lessons learned and rad resources from SDG Impact to help investors and enterprises to incorporate sustainability and impact into their decision-making and practices.

Lessons Learned

- There are many principles, standards, tools, and standardized metrics regarding Environmental, Social, and Governance (ESG) risk management and impact measurement and management for investors and enterprises, but it is unclear for practitioners when to use what, and how standards and best practices related to each other.

- There is a high risk of green- and purpose-washing without clear ESG and other impact standards.

- There is limited data on actual (ESG or other) impact performance of enterprises and investments.

- The adoption of reporting standards or impact tools does not necessarily imply the inclusion of impact considerations into business and investment decision-making processes.

- Focus on financial ESG risks and sustainability impacts is not sufficient to address the enormous environmental and social challenges we face in achieving the SDGs.

- Impact targets are often decided based on preferences or limited data, not based on evidence.

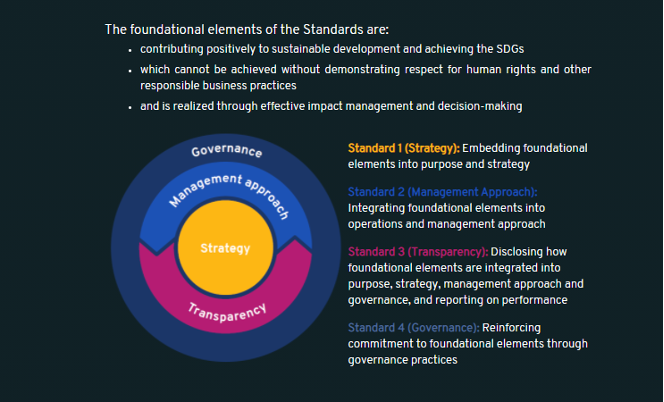

In response to the lessons learned, SDG Impact is building a bridge between high level principles and tools, metrics, taxonomies and reporting frameworks through the SDG Impact Standards. These standards are specific to private equity, bonds and enterprises. They link to other useful frameworks and tools, but with the flexibility to add or replace these as new ones become available or as needs change.

Rad Resources

- SDG Impact Standards for Private Equity: For private equity, debt, and venture capital fund managers who want to make a positive contribution to sustainable development and achieving the SDGs through one or more of their funds.

- SDG Impact Standards for Bonds: For Issuers who want to contribute positively to sustainable development and achieving the SDGs through issuing bonds related to achieving SDG and/or other sustainable development outcomes. The standards are designed to align SDG Bond Programs with the broader sustainability strategies and SDG commitments of the Issuer and/or entity utilizing the capital, as appropriate.

- SDG Impact Standards for Enterprises: For enterprises committed to contributing positively to sustainable development and towards achieving the SDGs. All enterprises – irrespective of size, geography, or sector – can use the standards. This includes publicly listed enterprises, public-interest and private entities (both for-profit or not-for-profit), non-governmental organizations (NGOs), small and medium enterprises (SMEs), and state-owned or other public-sector entities.

- SDG Investor maps: In-depth reports on SDG-enabling investment opportunities and conditions in target markets and sectors. Examples of Investor maps: Brazil, Colombia, Turkey, South Africa.

The American Evaluation Association is hosting Social Impact Measurement Week with our colleagues in the Social Impact Measurement Topical Interest Group. The contributions all this week to aea365 come from our SIM TIG members. Do you have questions, concerns, kudos, or content to extend this aea365 contribution? Please add them in the comments section for this post on the aea365 webpage so that we may enrich our community of practice. Would you like to submit an aea365 Tip? Please send a note of interest to aea365@eval.org. aea365 is sponsored by the American Evaluation Association and provides a Tip-a-Day by and for evaluators. The views and opinions expressed on the AEA365 blog are solely those of the original authors and other contributors. These views and opinions do not necessarily represent those of the American Evaluation Association, and/or any/all contributors to this site.

Hello Belissa,

I think it is important for companies and firms to take into consideration using sustainable resources at the time of making their decisions. It would do everyone a big favor, in the long run, to care for the environment’s wellbeing.