Hi – I’m Gwendolyn Zorn, Head of Impact at Phatisa, a sector-specific African private equity fund manager located in and operating across sub-Saharan Africa. Phatisa has three funds under management, totaling more than $400 million, focused on food and affordable housing. When I joined Phatisa in 2017, the firm had a somewhat fundamental understanding of impact: we reported annually on jobs created, taxes paid, food and houses output, and a few other indicators meant to convey our impact story.

But it wasn’t enough. We were touching many lives and making material contributions to food security in the geographies where we had invested, including Sierra Leone, Malawi, Zambia, and the DRC. We had an impact story to tell, and I committed to figuring out how to do it in a measurable way while taking into account best practices such as discounting results for attribution (the concept that when people identify more than one reason for an occurrence, uncertainty causes them to discount the importance of each reason identified).

Hot Tips:

- My first challenge was the lack of real baseline data. We hadn’t determined the status quo at the time of investment from which to tell a story of change or impact. So, my first tip to anyone in the impact measurement and management field is important but obvious: Collect good baseline data at the beginning. Define the impact proposition of the company/project, draft a Theory of Change, and choose indicators that speak to that. We were stuck retrofitting historical data into our system—you don’t want to be in that position.

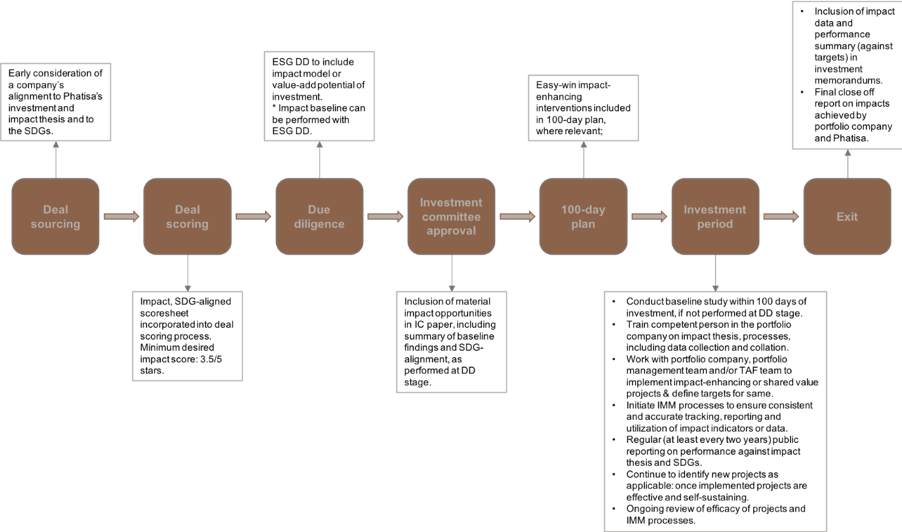

- I then began formalizing our impact procedures into a management document with supporting resources. This included defining how impact considerations and impact assessment would fit into the investment process (see graphic) from deal sourcing through exit. Having an approved internal process document was a big step, and it required me to do some convincing. This is my next tip: Be assertive in what you are trying to achieve and remain steadfast. Once you see people’s mindsets start to shift, you will get the buy-in you need to drive your mission. We now approach a wider range of potential investors because we began publishing data-driven impact reports and have a sophisticated impact management system built around the sustainable development goals.

- When working with multiple entities (we have 14 portfolio companies), you must trust that the data you receive is valid and reliable. It’s important to train at least one person at the portfolio company level on your indicators, how they are defined, and where to source the data. Our aim is annual on-the-ground verification, but we know we must have reliable resources in place that are well-trained on what we are looking for and why. From there, it is necessary to establish a cutoff point after which the data that comes in is trusted. Letting other people control the process is a lesson I’ve had to learn, and I’m sure there will be more along the way.

The American Evaluation Association is celebrating Social Impact Measurement Week with our colleagues in the Social Impact Measurement Topical Interest Group. The contributions all this week to aea365 come from our SIM TIG members. Do you have questions, concerns, kudos, or content to extend this aea365 contribution? Please add them in the comments section for this post on theaea365 webpage so that we may enrich our community of practice. Would you like to submit an aea365 Tip? Please send a note of interest to aea365@eval.org. aea365 is sponsored by theAmerican Evaluation Association and provides a Tip-a-Day by and for evaluators.

Pingback: #EvalTuesdayTip: Impact Investing and Evaluation - Khulisa