This is Karim Harji and Ted Jackson from ET Jackson & Associates, and our contribution on social impact measurement (SIM) focuses on training and curriculum development for evaluators and practitioners.

Lessons Learned:

Training and Cross-Sector Collaboration

Impact investing – a field that has seen much growth over the last decade, through a combination of strategic grant making and industry development – is steadily gaining attention and traction.. While this is new terrain for evaluators, there are several resources on both impact investing and impact measurement, and strategies for evaluators, for engaging in this area.

In collaboration with several African institutions – the CLEAR Centre at Wits University and Greater Capital in South Africa; and the Venture Capital Trust Fund, GIMPA Centre for Impact Investing, and the Institute for Policy Alternatives in Ghana – together with funding from the Rockefeller Foundation and IDRC, we developed and delivered executive education training workshops in Ghana and South Africa.

These workshops not only brought evaluators, practitioners and policymakers, but also stimulated cross-sector conversation on the relevance of measurement. Participants shared approaches and tools for their local contexts, and emphasized the need for greater cross-sector collaboration among investors, fund managers, social enterprises, evaluators and governments.

Developing Curriculum and Resources

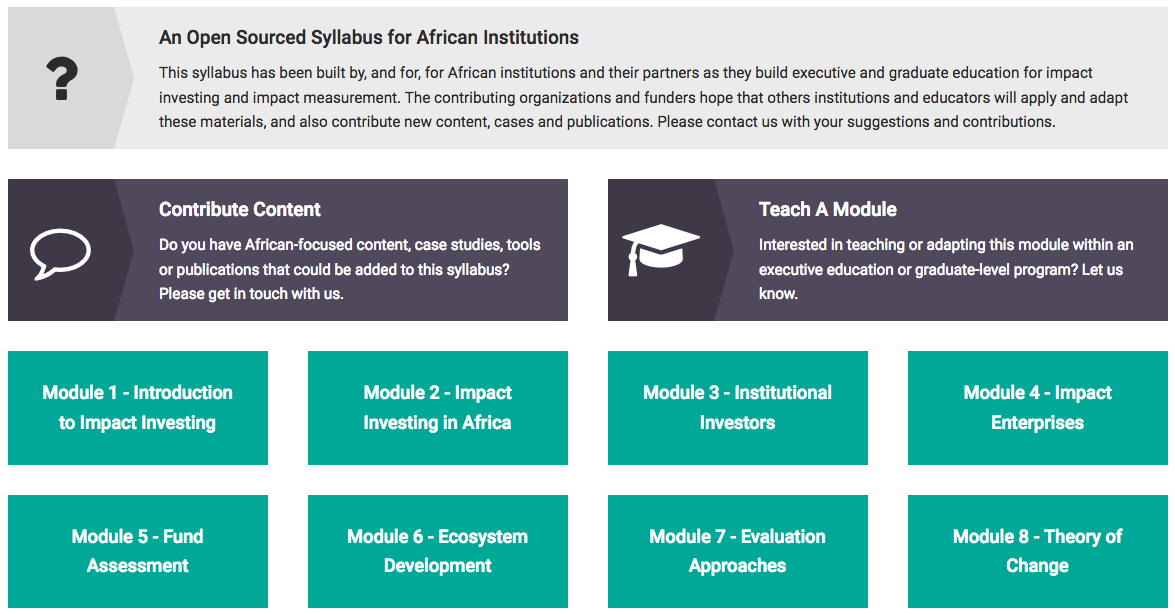

Inspired by these sessions and the range of perspectives that were represented, we designed an open source curriculum on “Evaluating Impact Investing”. The course is built around three broad themes—building the field of impact investing, measuring the success of impact investments, and understanding the special issues emanating from the African context.

Impact investing in Africa is characterized by much dynamism, and as such, the course consists of 24 different modules – on topics such as Evaluation Approaches, Standards, Global Goals, Household Impacts, Negative Outcomes, and Evaluation Costs – with supporting notes, examples, case profiles, exercises and readings. We explore the use of well-known approaches such as Theory of Change, as well as contextual adaptations for engaging with the private sector.

This curriculum is a resource that we hope that academic organizations and evaluation networks can use and adapt for their own needs. That said, there is much more to be done, including more case studies authored by African researchers, and evaluation tools that are adapted for use within each region. We welcome contributions and suggestions from evaluators, as well as those who are designing and delivering training and education in evaluation.

(click for larger image)

Interested in learning more? For more information about the SIM TIG, see here. To join the SIM TIG, see here.

The American Evaluation Association is celebrating Social Impact Measurement Week with our colleagues in the Social Impact Measurement Topical Interest Group. The contributions all this week to aea365 come from our SIM TIG members. Do you have questions, concerns, kudos, or content to extend this aea365 contribution? Please add them in the comments section for this post on the aea365 webpage so that we may enrich our community of practice. Would you like to submit an aea365 Tip? Please send a note of interest to aea365@eval.org. aea365 is sponsored by the American Evaluation Association and provides a Tip-a-Day by and for evaluators.

Hi Karim Harji and Ted Jackson,

My name is Bianca and I am a student at Queens University currently taking a course on program evaluation. I am new to the subject of evaluation and in reading through articles I came across yours and found it to be very interesting to me. I have never heard of impact investing before, which is a bit unfortunate as I have a bachelor of commerce. After reading your article, I did a bit of research on impact investing and I must say that I am hooked on the idea! Now you will have to forgive me as I am new to evaluation, but I did have a question in regards to an evaluation on an impact investment. From what I was reading, impact investing aims at bringing together investments and social impact, and most impact investments aim for a social impact as well as an economic return. I have only been exposed so far to evaluations on social programs with no investment return criteria. What do you find are the most difficult challenges you face during an evaluation specifically relating to the financial responsibility aspect of the program and in dealing with the investors?

Thank-you for your article and your time in reviewing my response.

Bianca