Hi, we’re Debby Nixon Williams, Noel Verrinder and Kagiso Zwane. We are from Genesis Analytics, a South African economics consultancy based in Johannesburg (HQ), Nairobi and London. Our team provides evaluation, monitoring and learning advisory services to donors, foundations, NGOs, the public sector, and the private sector in the form of impact investors across Sub-Saharan Africa.

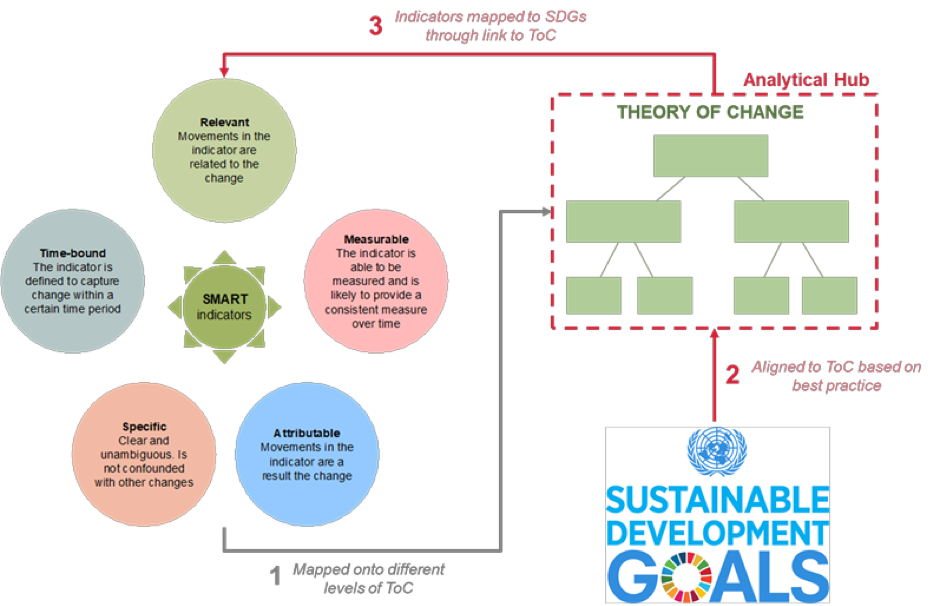

The Sustainable Development Goals (SDGs) are becoming increasingly important to funders and donors in the measurement of impact. For this reason, impact investment fund managers are beginning to integrate SDG tracking mechanisms in their monitoring systems. Unfortunately, in our experience, as well as others with whom we have discussed the same issue, it seems that they do this to meet the demands of donors or investors rather than to experience any benefit themselves. We have found that using a theory of change to connect the actions of the impact investors to SDG related indicators helps fund managers to own and articulate the social impact of their work.

Lessons Learned: This diagram is a useful way of showing impact investors the value of concise indicators rooted in a theory of change that is aligned with the SDGs.

- A theory of change helps fund managers recognize that while this may be pushed on them, the value derived from the process of integrating SDG’s into an impact investment fund’s monitoring helps fund managers and beneficiaries better articulate their purpose and goals for impact.

- The wide range of impact measurement tools available to fund managers can often lead to “impact wash”. Impact wash, in this instance, means impact investors try to demonstrate they are contributing towards impact through so many indicators that these indicators overwhelm the audience and undermine the impact message of the fund. We find that working with fund managers to focus their impact ambitions around SDG’s achieves a grounding and shared understanding of their impact aims, focuses the organisation’s monitoring and generates a space to consider innovative measurements for social impact that are pertinent to tracking progress toward and adapting strategies to achieve our global 2030 goals.

- Using the UN SDG global indicators is a good starting point to help link impact investment activites for donors and provides a sound starting point to ensure SMART indicators that are pertinent.

Leason Learned: Ultimately, in our experience, using a theory of change has proven to be a valuable analytical hub for impact investors and allows them to consolidate their understanding of impact in a clear format.

Rad resources

- Interrogating the theory of change: evaluating impact investing where it matters most; Journal of Sustainable Finance & Investment; Edward T. Jackson

- Mobilizing Impact Capital from Retail Investors: SDG Investing as the “New Normal”; Triodos Bank

- Achieving the sustainable development goals: the role of impact investing; Global Impact Investment Network (GIIN)

The American Evaluation Association is celebrating Social Impact Measurement Week with our colleagues in the Social Impact Measurement Topical Interest Group. The contributions all this week to aea365 come from our SIM TIG members. Do you have questions, concerns, kudos, or content to extend this aea365 contribution? Please add them in the comments section for this post on the aea365 webpage so that we may enrich our community of practice. Would you like to submit an aea365 Tip? Please send a note of interest to aea365@eval.org. aea365 is sponsored by the American Evaluation Association and provides a Tip-a-Day by and for evaluators.