Greetings! I’m Edward Jackson, a consultant and professor, and this blog is focused on the role of the evaluators in actually building emerging fields of practice, not only assessing them. These observations grow out of my experience, along with that of other colleagues, in engaging with the impact investing industry over the past five years.

According to the Global Impact Investing Network (GIIN), a non-profit trade group: “Impact investments are investments made into companies, organizations, and funds with the intention to generate measurable social and environmental impact alongside a financial return.”

During the past half-decade, several hundred organizations—foundations, banks, NGOs, corporations, pension funds–have built new investment products and funds, professional networks and measurement systems to create a nascent industry that currently manages about $50 billion in assets worldwide but whose potential is estimated to be ten times that number.

However, while there have been impressive gains and innovations in impact investing practice, the field-building effort (as with most other fields, in fact) is moving more slowly than its leaders anticipated. All hands are needed on deck to accelerate this process.

Hot Tips: Evaluators bring important skills and knowledge, especially in learning, in real time, what works and what doesn’t in practice. But how should they become field-builders? What actions should they take? Three tips from our experience may be useful:

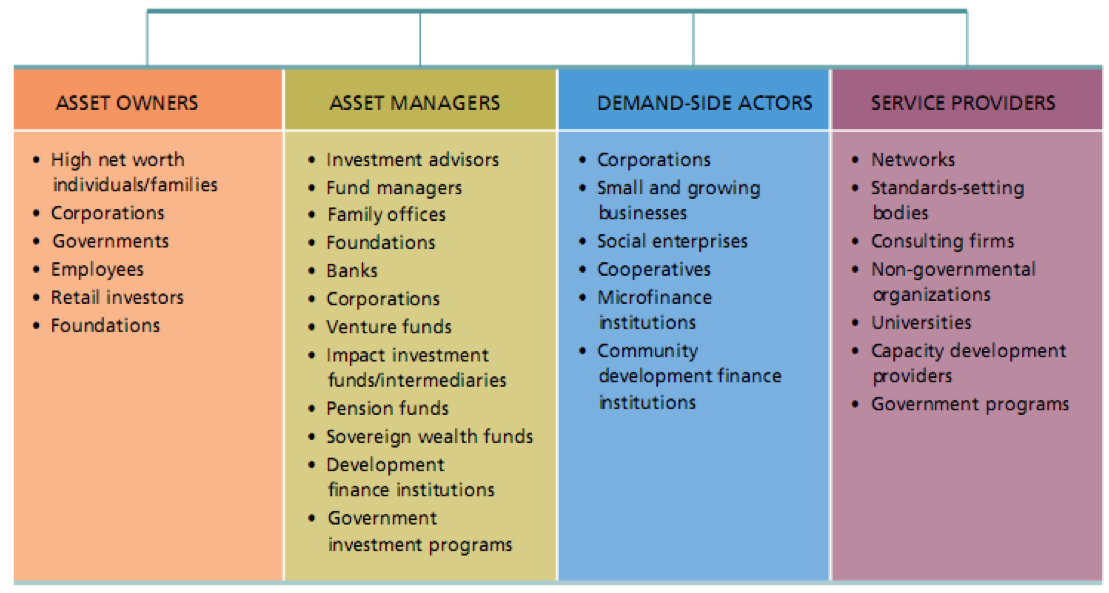

- Understand who the actors are and how they relate to each other. The impact investing industry brings together a unique combination of actors: asset owners, asset managers, demand-side actors (investees) and service providers. And finance and investment professionals have very specific cultural and organizational incentives and practices that must be understood in detail.

- Examine the field-building tactics being deployed, and reinforce non-proprietary efforts. From jointly branded research products to earned media coverage, the impact investing industry has been vigorous and creative in its choices and applications of field-building tactics. Foundation and government grant-makers play central roles in underwriting this work.

- Mobilize the best knowledge generated by good evaluation and inject it into the field-building process. Through professional and academic articles, conference presentations, social media posts, we have sought to disseminate our evaluation findings and lessons across the impact investing industry. Webinars and online courses are natural next steps.

A final word: It is essential that evaluators maintain their independence as actors within the field they are helping to build. So far, our experience is that it is possible to do so.

Rad Resource: See Edward Jackson and Karim Harji, Field-Building that Lasts: Ten Field-Building Tactics for the Impact Investing Industry, Rockefeller Foundation, 2013. (And four other briefs).

The American Evaluation Association is celebrating Nonprofits and Foundations Topical Interest Group (NPFTIG) Week. The contributions all this week to aea365 come from our NPFTIG members. Do you have questions, concerns, kudos, or content to extend this aea365 contribution? Please add them in the comments section for this post on the aea365 webpage so that we may enrich our community of practice. Would you like to submit an aea365 Tip? Please send a note of interest to aea365@eval.org. aea365 is sponsored by the American Evaluation Association and provides a Tip-a-Day by and for evaluators.